Post $20,000 Insurance Payment in 5 Minutes? You can with DOX|ERA™

How long does it take your staff to enter a $20,000 insurance check covering over 100 claims? Many offices report that it could take up to two hours. What if we told you that we have a new feature in DOX that will automatically post those same 100+ claim payments in five minutes or less? Perhaps, you would respond like many of our clients “There is no way you can apply insurance payments that fast and be as thorough as we are!” Those same disbelievers are totally thrilled (and ready to sign up) when they see the automatic payment process in action. This time-saving, automated insurance payment process is called ERA (Electronic Remittance Advice), and is fully integrated with all the existing insurance processing and estimating features of DOX.

How does the ERA process work? ERAs are electronic EOBs that are downloaded to your DOX program each time you file electronic claims. Just like your paper EOB’s, the ERA might include one claim, claims for an entire family or plan, or hundreds of claims (such as a Medicaid check). While the ERA is not the actual payment, the value of the ERA, ranging from $0.00 to $100,000.00 or more, can be matched to a check or electronic fund transfer (EFT) that your office receives from the insurance company. Pre-determinations and denials are also communicated through ERAs. More than 300 insurance companies currently participate, including most commercial carriers, many state Medicaid programs, and third-party payors like DentaQuest and Health Partners (with only a handful of these companies requiring EFT payments).

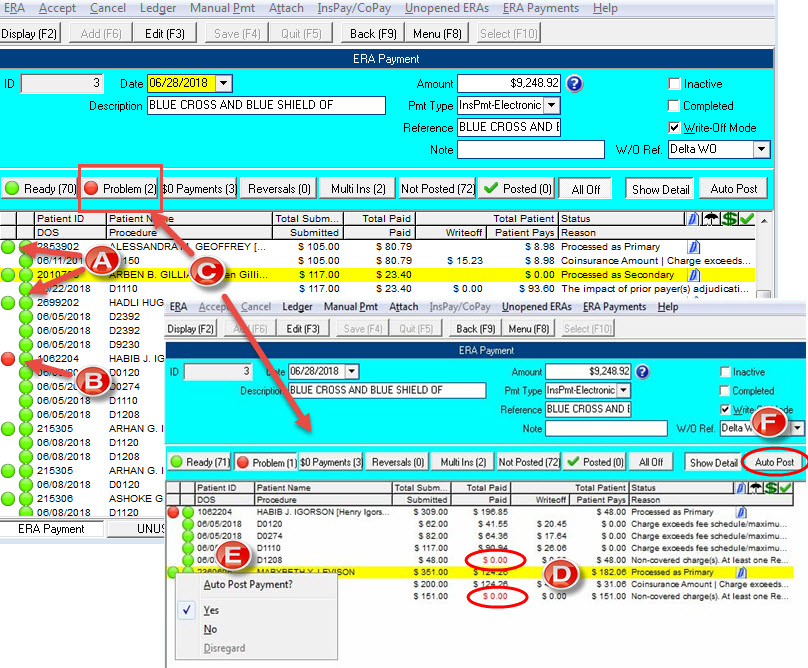

In the first week of implementing DOX|ERA, Dr. Rami Guirguis, Duluth, MN, received more than 100 ERAs. Most ERAs arrive before the EFT or check is received; thus they remain in the Unopened ERA list (found in Insurance|ERA|Unopened ERAs). Once an actual insurance payment is received by the office, the user matches that payment amount to the total of one of the ERAs in the Unopened ERA list, and then creates an ERA Payment which displays on a screen similar in layout to that of a bulk payment check (FIgure A).

In the first week of implementing DOX|ERA, Dr. Rami Guirguis, Duluth, MN, received more than 100 ERAs. Most ERAs arrive before the EFT or check is received; thus they remain in the Unopened ERA list (found in Insurance|ERA|Unopened ERAs). Once an actual insurance payment is received by the office, the user matches that payment amount to the total of one of the ERAs in the Unopened ERA list, and then creates an ERA Payment which displays on a screen similar in layout to that of a bulk payment check (FIgure A).

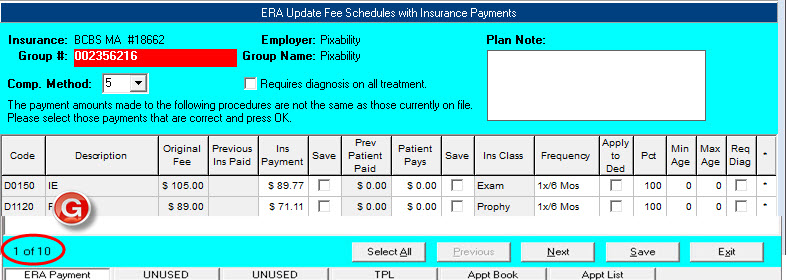

All the claim payments in an ERA Payment are compared against the unpaid claims in DOX. In most cases, 90% or more of the claims match perfectly and can be automatically posted in minutes (see Figure A). If one or more procedures on a claim cannot be matched, or the insurance company has paid $0.00 towards a procedure, the claim is flagged (in red) as a Problem and the user must review it (see Figure B). DOX provides many helpful menu options, filters and tools to assist users… in fact, we have designed the ERA workspace to be as versatile as the TPL screen, allowing the user to access all patient information directly from that screen. This feature alone, reports Dr. Guirguis, has significantly reduced the amount of time he spends reviewing claims that insurance plans have denied or paid differently than expected. For example, you can press F2 on the patient claim to view the secondary coverage or click (G) for Ledger to quickly review what the primary coverage paid. You can even select (T) for Manual Payment to apply the claim payment through the traditional method. This is especially helpful when you need to apply the payment to an invoice because the original claim was canceled or previously paid.

All the claim payments in an ERA Payment are compared against the unpaid claims in DOX. In most cases, 90% or more of the claims match perfectly and can be automatically posted in minutes (see Figure A). If one or more procedures on a claim cannot be matched, or the insurance company has paid $0.00 towards a procedure, the claim is flagged (in red) as a Problem and the user must review it (see Figure B). DOX provides many helpful menu options, filters and tools to assist users… in fact, we have designed the ERA workspace to be as versatile as the TPL screen, allowing the user to access all patient information directly from that screen. This feature alone, reports Dr. Guirguis, has significantly reduced the amount of time he spends reviewing claims that insurance plans have denied or paid differently than expected. For example, you can press F2 on the patient claim to view the secondary coverage or click (G) for Ledger to quickly review what the primary coverage paid. You can even select (T) for Manual Payment to apply the claim payment through the traditional method. This is especially helpful when you need to apply the payment to an invoice because the original claim was canceled or previously paid.

We have tested the new ERA payment entry on numerous databases that have received payments from a wide spectrum of insurance companies. Using these test files, we have tweaked our ERA payment feature to handle the common problems offices often encounter when posting payments. For example, often an insurance company reassigns a different procedure code to one that was originally filed, such as replacing a D1110 with a D1120. When the ERA is loaded, this claim will be tagged as a Problem. With a right mouse click on the red circle, the user can link up the procedures (thus changing the red circle to green) allowing the claim to be ready for automatic posting. If the ERA includes a payment for a patient that is seen in a different office, DOX allows the user to assign that payment to a fictitious patient in the database (such as the insurance account) and apply the payment to an invoice using the Manual Payment option. The ERA program even handles “recoups” or reversals. Our inital review of ERA files indicates that if an insurance company wants to recoup an insurance payment from the past, they send an ERA with a payment adjustment, which our ERA program properly applies to the original payment. In addition, the ERA feature handles secondary insurance filing, once the primary payment is posted.